Podcast

Kim addresses some of the most pressing issues related to tax and finance, and offers his professional and personal insights into what matters most for Canadians.

The 6th Anniversary of the Revamped TOSI Rules. Have They Been Effective?

In the latest podcast by Kim G C Moody, he reminisces on the 6th anniversary of the July 18, 2017 private corporation tax proposals. Specifically, he discusses:

- A short review of the July 18, 2017 tax proposals and the fury that resulted after that time.

- A discussion of whether or not the amendments to the tax on split income rules (“TOSI”) to curb income splitting amongst family members were necessary.

- A short discussion on whether or not Canada should adopt “family taxation” as first proposed by The Royal Commission on Taxation’s report released in 1966. Wouldn’t family taxation eliminate the desire to income split?

- Have the amended TOSI rules been effective?

Happy listening!

The Need For Tax Reform in Canada

I think it’s long overdue that Canada engages in comprehensive tax reform and review. Our country needs fresh eyes on how we tax, what we should tax, and how we improve our tax system for all Canadians.

Video

MacKay Forums Time Management Webinar

Response to Justin Trudeau’s Capital Gains Taxation

Kim G C Moody in conversation with Dr. Jack Mintz – November 14, 2023

How Do You Learn To Be A Better Leader? – November 6, 2023

Book me for your next event.

Join Our

Mailing List

Be Better Informed

About Tax

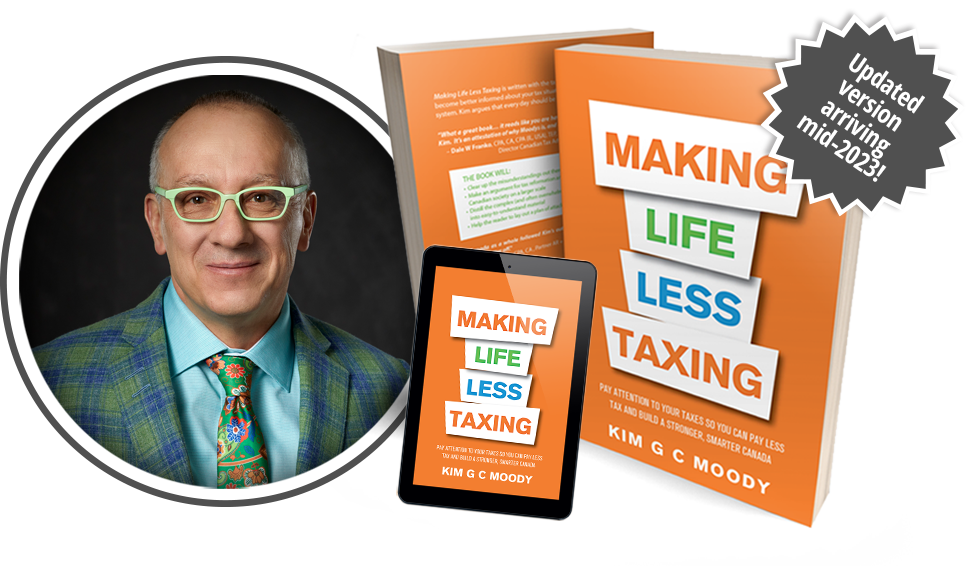

In March 2020, I published my first book, “Making Life Less Taxing,” - an Amazon bestseller in several categories, including reaching: #1: Taxes; Industries and Professions; Accounting; Corporate; Corporate Tax Accounting; Tax Accounting. #2: Accounting and Finance. #3: Professional and Technical.